All Categories

Featured

Table of Contents

[/image][=video]

[/video]

Roth 401(k) payments are made with after-tax payments and then can be accessed (incomes and all) tax-free in retired life. Rewards and resources gains are not taxed in a 401(k) strategy. Which item is finest? This is not an either-or decision as the items are not alternatives. 401(k) strategies are made to assist workers and company owner build retired life cost savings with tax obligation advantages plus get prospective company matching payments (cost-free added cash).

IUL or term life insurance policy may be a requirement if you intend to pass money to successors and do not think your retired life savings will certainly meet the goals you have actually defined. This product is intended only as general info for your benefit and must not in any kind of method be interpreted as financial investment or tax obligation guidance by ShareBuilder 401k.

Iul Vs Roth Ira

Your monetary scenario is unique, so it's vital to locate a life insurance policy product that fulfills your certain requirements. If you're looking for life time protection, indexed universal life insurance policy is one option you may intend to think about. Like other irreversible life insurance products, these policies allow you to construct cash value you can tap during your life time.

That suggests you have much more long-term development possibility than a whole life policy, which supplies a fixed price of return. Commonly, IUL policies prevent you from experiencing losses in years when the index sheds value.

Understand the advantages and downsides of this product to determine whether it lines up with your monetary goals. As long as you pay the costs, the plan stays in pressure for your entire life. You can collect cash money worth you can use throughout your life time for numerous monetary requirements. You can adjust your costs and survivor benefit if your scenarios transform.

Long-term life insurance policy plans commonly have greater first premiums than term insurance, so it may not be the appropriate option if you're on a tight budget plan. The cap on rate of interest credit ratings can limit the upside capacity in years when the securities market executes well. Your policy could gap if you take out as well big of a withdrawal or plan car loan.

With the possibility for more robust returns and adjustable settlements, indexed global life insurance policy might be an alternative you wish to take into consideration. If taken care of yearly returns and locked-in costs are very important to you, a whole life plan might represent the far better option for irreversible coverage. Curious to find out which insurance product fits your needs? Connect to a financial specialist at Colonial Penn, who can review your individual circumstance and offer customized understanding.

Iuf Uita Iul

The info and summaries consisted of below are not intended to be total descriptions of all terms, problems and exemptions relevant to the products and services. The precise insurance policy coverage under any type of COUNTRY Investors insurance policy item is subject to the terms, conditions and exemptions in the real policies as issued. Products and services described in this internet site vary from one state to another and not all products, coverages or services are available in all states.

If your IUL policy has appropriate money worth, you can obtain versus it with versatile settlement terms and reduced interest rates. The choice to create an IUL plan that reflects your certain needs and circumstance. With an indexed global life policy, you allot premium to an Indexed Account, thus producing a Sector and the 12-month Sector Term for that segment starts.

At the end of the sector term, each segment gains an Indexed Debt. An Indexed Credit history is calculated for a sector if value continues to be in the sector at section maturity.

These limitations are established at the beginning of the sector term and are ensured for the entire segment term. There are 4 selections of Indexed Accounts (Indexed Account A, B, C, and E) and each has a different type of restriction. Indexed Account An establishes a cap on the Indexed Credit rating for a section.

The development cap will vary and be reset at the start of a sector term. The participation rate identifies just how much of an increase in the S&P 500's * Index Value puts on sections in Indexed Account B. Higher minimum growth cap than Indexed Account A and an Indexed Account Fee.

What Is An Indexed Universal Life Policy

There is an Indexed Account Charge connected with the Indexed Account Multiplier. Regardless of which Indexed Account you pick, your cash worth is always shielded from adverse market efficiency.

At Sector Maturity an Indexed Credit score is computed from the change in the S&P 500 *. The worth in the Sector makes an Indexed Debt which is determined from an Index Growth Price. That growth price is a portion modification in the existing index from the beginning of a Segment up until the Segment Maturity date.

Segments immediately restore for another Segment Term unless a transfer is asked for. Costs received given that the last move day and any asked for transfers are rolled right into the same Sector to ensure that for any month, there will certainly be a single new Section developed for a provided Indexed Account.

Iul Life Insurance Calculator

You might not have thought much concerning how you desire to invest your retired life years, though you possibly know that you don't desire to run out of money and you 'd like to preserve your present way of life. [video: Text appears next to the business man speaking to the camera that reads "company pension", "social security" and "savings".] In the past, individuals relied on 3 major incomes in their retired life: a business pension plan, Social Security and whatever they would certainly managed to save.

Less employers are supplying typical pension. And lots of firms have lowered or ceased their retirement. And your capacity to rely exclusively on Social Safety remains in concern. Also if advantages have not been minimized by the time you retire, Social Safety alone was never ever planned to be adequate to spend for the lifestyle you desire and are entitled to.

Fixed Indexed Universal Life Insurance Reviews

While IUL insurance coverage might show important to some, it's essential to understand just how it works prior to acquiring a plan. Indexed global life (IUL) insurance policies provide better upside possible, adaptability, and tax-free gains.

companies by market capitalization. As the index relocates up or down, so does the rate of return on the cash value part of your plan. The insurance provider that releases the policy may offer a minimal guaranteed price of return. There might likewise be a ceiling or price cap on returns.

Economic professionals usually encourage having life insurance coverage that's equal to 10 to 15 times your yearly earnings. There are several downsides related to IUL insurance plan that movie critics fast to explain. For circumstances, someone that develops the policy over a time when the market is choking up could wind up with high costs repayments that don't add in all to the cash worth.

Besides that, remember the adhering to various other factors to consider: Insurance provider can set involvement rates for just how much of the index return you get yearly. Let's say the policy has a 70% participation rate. If the index grows by 10%, your cash value return would certainly be just 7% (10% x 70%).

On top of that, returns on equity indexes are typically topped at an optimum amount. A plan might state your maximum return is 10% annually, despite how well the index executes. These constraints can limit the actual price of return that's credited towards your account annually, despite how well the policy's underlying index performs.

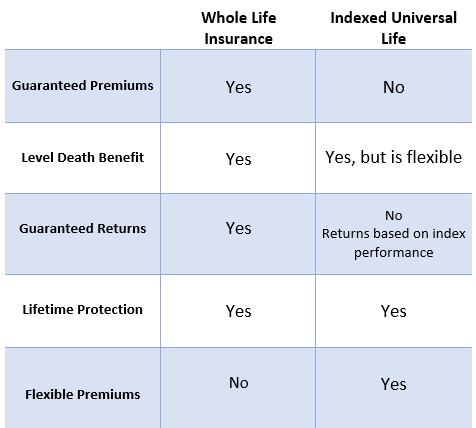

However it is essential to consider your personal threat resistance and financial investment goals to make certain that either one aligns with your general technique. Entire life insurance policy plans often consist of an assured rates of interest with predictable superior quantities throughout the life of the plan. IUL plans, on the various other hand, deal returns based upon an index and have variable costs over time.

Latest Posts

Iul Indexed Universal Life

Transamerica Iul Review

Is Indexed Universal Life A Good Investment